THE EV BOOM AND $200B+ IN COPPER-RELATED INFRASTRUCTURE SPENDING SPEAK TO UNTAPPED POTENTIAL

Yet Soaring Inflation and a Supply-Demand Crisis are Potential Catalysts that have Alpha Copper Corp.’s (CSE: ALCU) (OTC: ALCUF) Stock Skyrocketing

News Update:

October 3, 2022 Alpha and CAVU Announce Signing of Definitive Agreement

August 22, 2022 Alpha Copper Corp. Enters into Letter of Intent to Acquire CAVU Energy Metals Corp.

August 11 , 2022 Alpha Copper Provides Indata Project Drill Campaign Update

June 16, 2022 Alpha Copper Commences Mobilization to Indata Copper-Gold Project

May 4, 2022 Alpha Copper Okeover Property Granted Permit Extension

May 4, 2022 Alpha Copper Increases 2022 Budget for Indata Copper-Gold Project

Apr 26, 2022 Alpha Copper Views Long Term Sector Growth

Mar 17, 2022 Alpha Copper Plans Aggressive 2022 Campaign

Mar 11, 2022 Alpha Copper Makes First Payment to Acquire Okeover Copper Project

Feb 26, 2022 Alpha Copper Closes $7,577,267 Private Placement

Top 4 Potential Catalysts for Alpha Copper Corp.

(CSE: ALCU) (OTC: ALCUF)

1. Bullish Indicators have Alpha Copper Corp. On Fire 🔥🔥🔥

2. Copper bull market due to unprecedented demand

3. Growing EV Boom, Greening Economy, and Infrastructure Bill are all dependent on Copper

4. Two Impressive Projects in a Mining-Friendly Region

The market in 2022 has kicked off with a muted sentiment. This isn’t the free ride we had a year ago when interest rate hikes were not on the Fed’s radar. Worst-case scenarios also said that potential inflation could be transitory at worst.

That seems like forever ago.

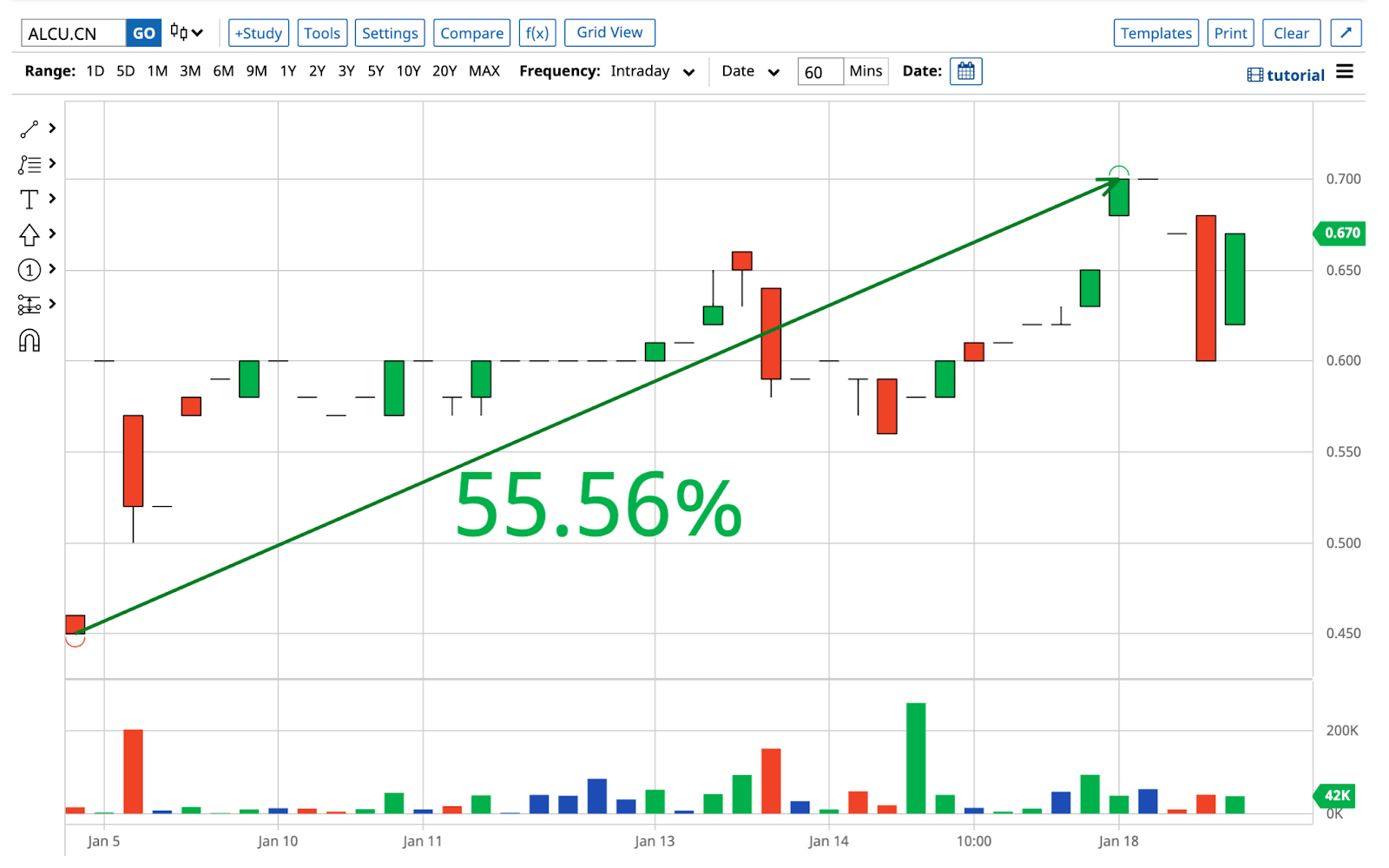

The broader market has sputtered to start 2022. But look deeper. A little-known mining stock has stormed out of the gate, rallying as much as 55+% just 18 days into the New Year. (Source 2)

Meet Alpha Copper Corp. (CSE: ALCU) (OTC: ALCUF)

Mounting economic headwinds, including inflation, supply chain issues, and a global energy crisis, are striking fear into the people’s hearts. We aren’t blind to it. Instead of feeling sorry for yourself, consider why this copper explorer has rocketed during these times.

Beyond Alpha’s potential resiliency to inflation as a copper explorer, we could have a severe supply-demand crunch amid EV demand. The move to electric vehicles simply will not be possible without new sources of copper from companies like Alpha because of the ungodly amount of copper that EVs need.

What’s more, the recently passed massive infrastructure spending bill in the U.S. could require $200B+ worth of projects reliant on copper. (Source 1)

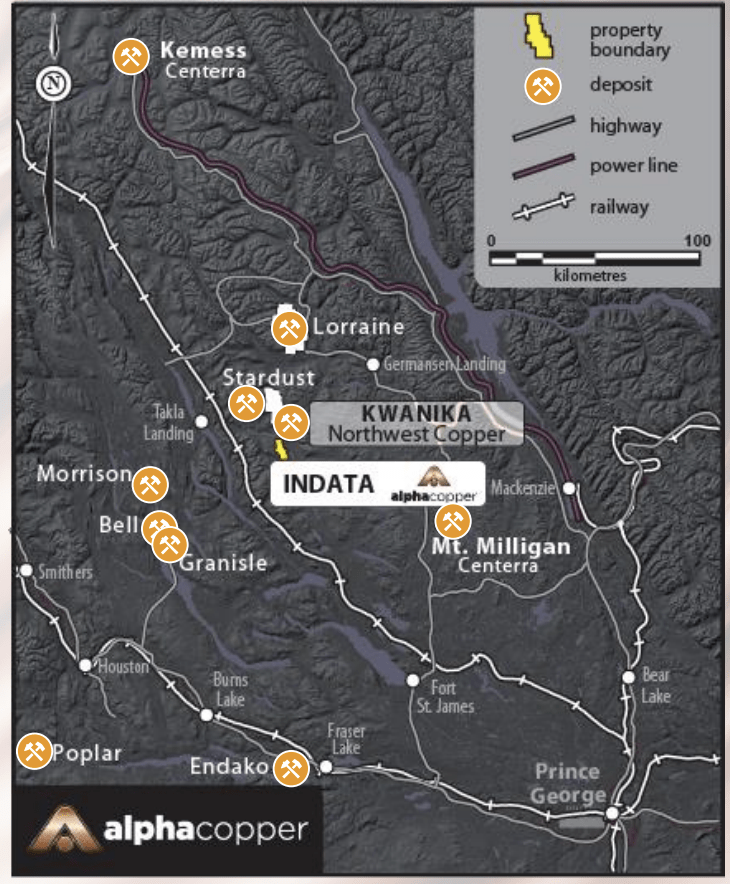

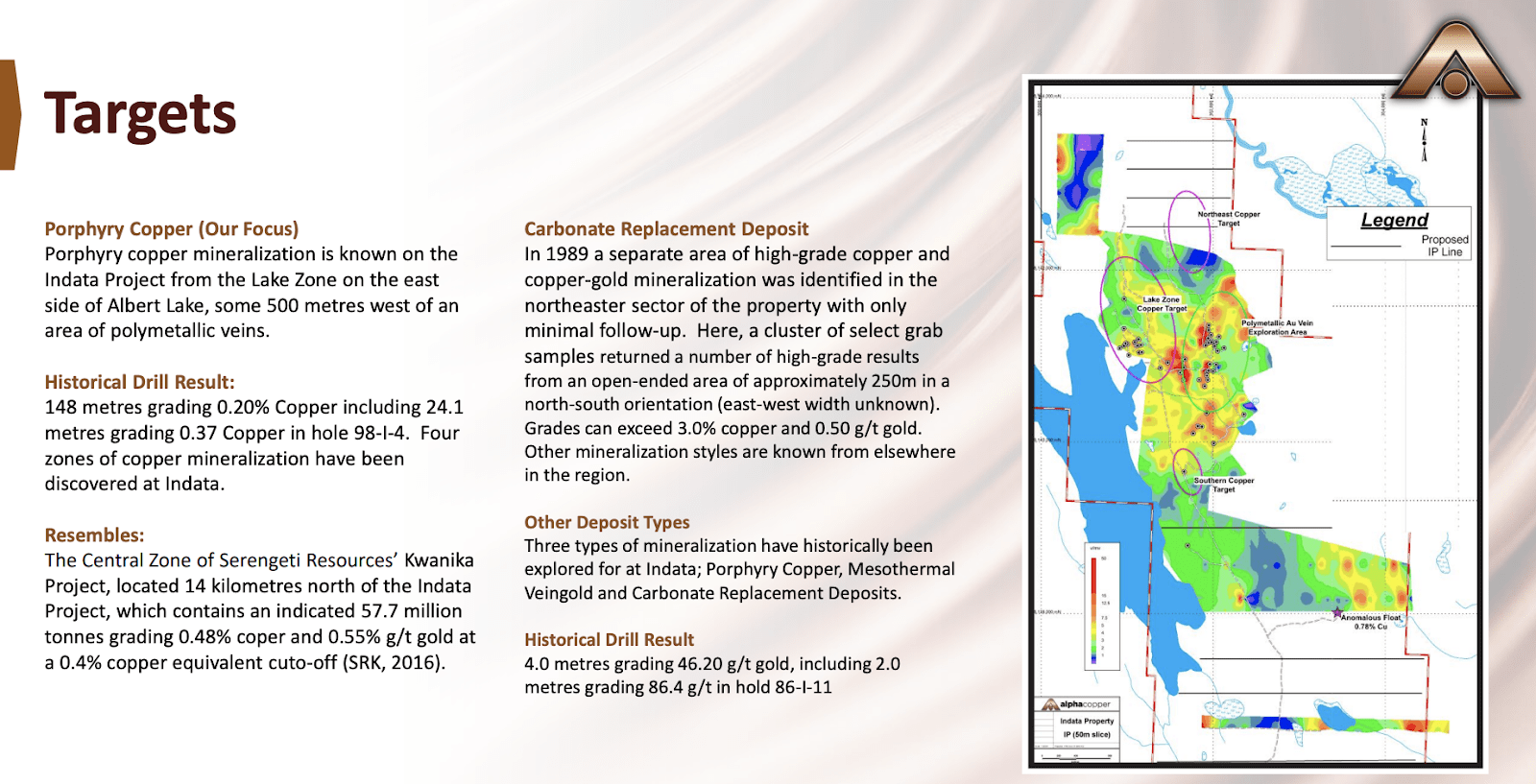

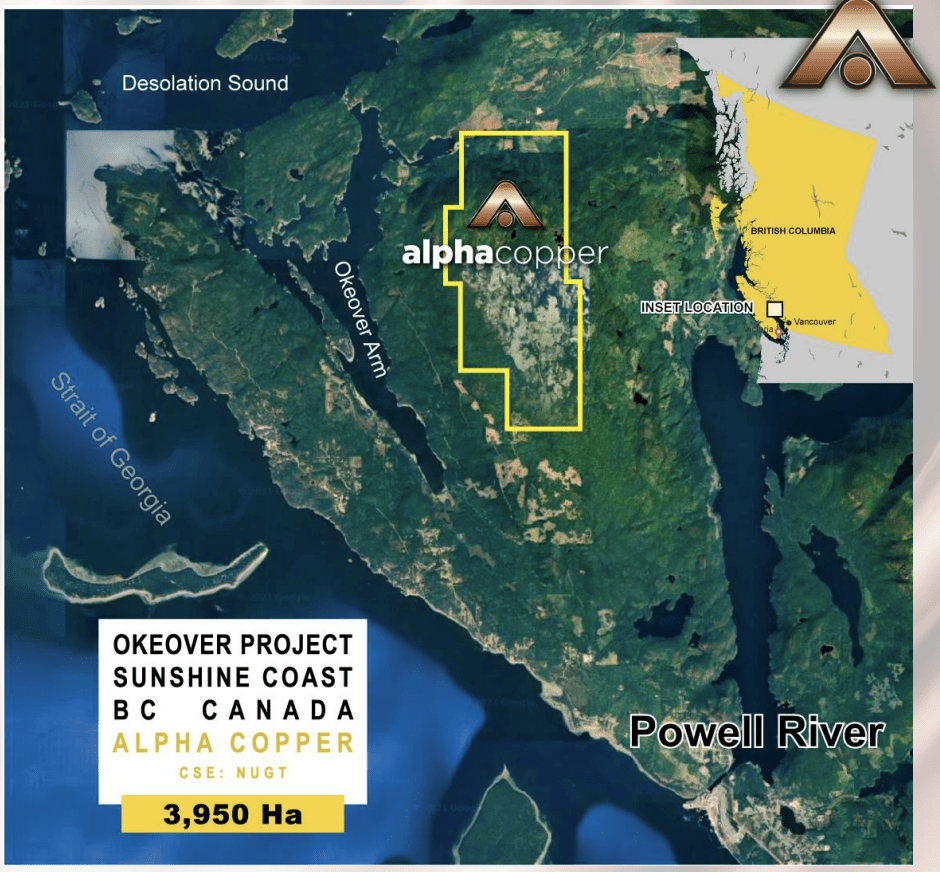

As a Canadian mineral exploration company focused on advancing its Indata and Okeover (“OK”) Projects in mineral-rich British Columbia, Canada, Alpha Copper has the ingredients. Both projects contain numerous drill-ready targets and geophysical anomalies. Indata is also located just 3 km from 2 of the most promising copper discoveries in Canada, Kwanika and Stardust. (Source 1)

So read on and see why Alpha Copper Corp. (CSE: ALCU) (OTC: ALCUF) could be one of the hottest companies in 2022.

Reason #1: Market Bumming You Out? Bullish Indicators Have Alpha Copper Corp. On Fire

(CSE: ALCU) (OTC: ALCUF)

Within the first few trading weeks of 2022, the indices have stumbled.

The sentiment isn’t what it once was, and investors are rightfully concerned. As of Jan 18, 2022, from highs around the start of the year, the Dow has dipped as much as -4.41%, (Source 3) the S&P -5.01%, (Source 4) and the Nasdaq -8.49%. (Source 5)

That has simply not been the case for Alpha Copper Corp. (CSE: ALCU) (OTC: ALCUF).

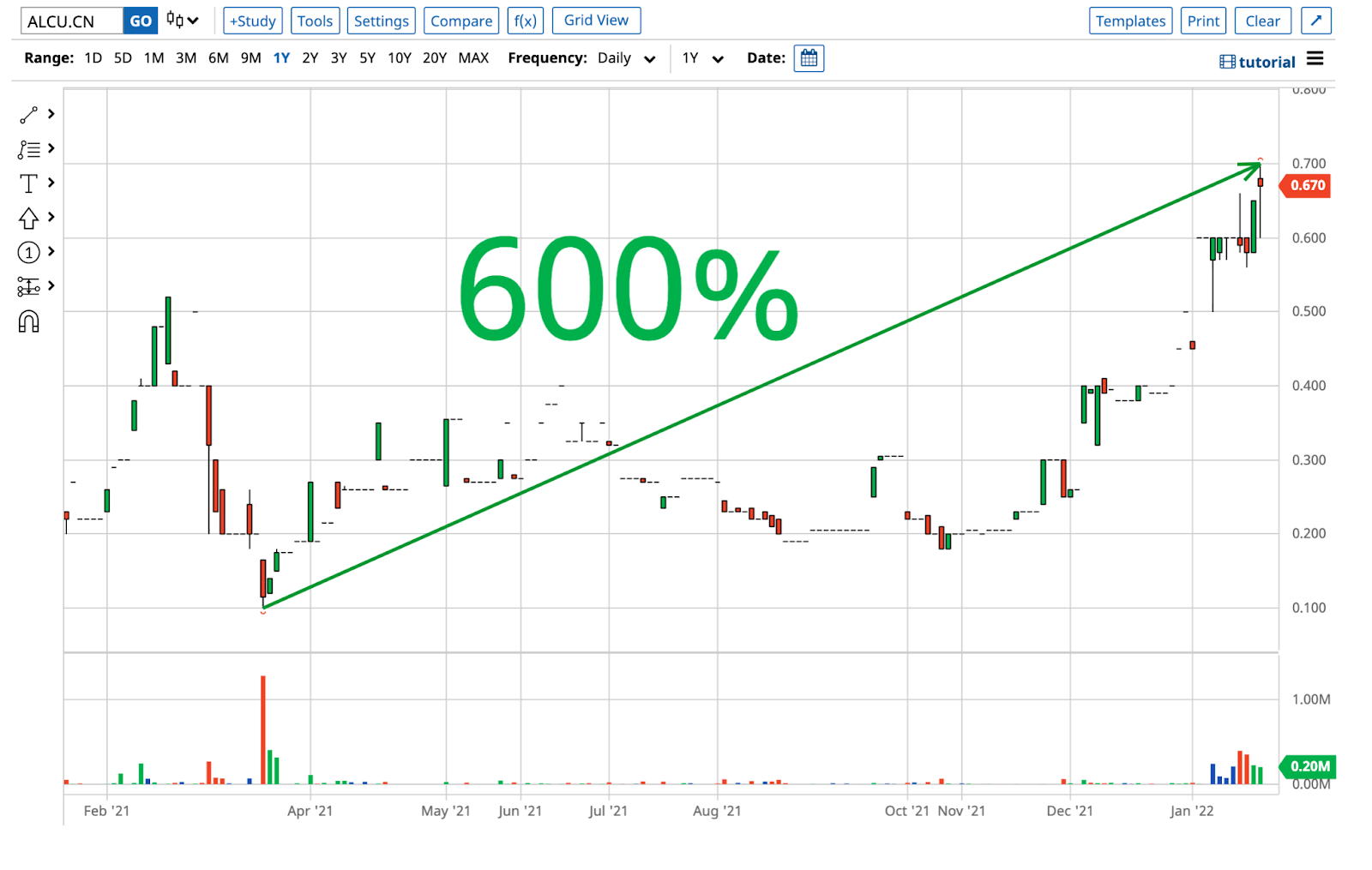

The stock has not only outperformed, it has shattered these moves and charged out of 2022’s gate like a possessed bull. It has practically seen a vertical surge ever since the ball dropped, running over 55% from a low of CAD $0.45 on Jan 4, 2022, to a high of CAD $0.70 on Jan 18, 2022. (Source 2)

This only scratches the surface of what’s been a long-term trend for the stock. Since trading at little more than a Canadian dime per share on Mar 22, 2021, the stock’s price has exploded about 600%. (Source 2)

Yet while skeptics may say the stock could be overdue for a cooling-off period, the data and indicators show that this may only be the start.

Coupled with copper’s potential catalysts, the stock is flashing many short-, medium-, and long-term bullish technical indicators as of Jan 18, 2022. Some of its triggered indicators include its 20 Day Moving Average, 20 – 50 Day MACD Oscillator, 20 – 100 Day MACD Oscillator, 20 – 200 Day MACD Oscillator, 50 Day Moving Average, 50 – 100 Day MACD Oscillator, 50 – 150 Day MACD Oscillator, 50 – 200 Day MACD Oscillator, 100 Day Moving Average, 150 Day Moving Average, 200 Day Moving Average, and 100 – 200 Day MACD Oscillator. (Source 6)

Moreover, as of Jan 19, 2022, ALCU had a float of roughly 18.76M, with 38.82% of shares held by insiders. (Source 7) The stock has also seen its market cap multiply by more than 4x from 2.07M to 8.45M ever since Mar 31, 2021. (Source 7)

When you see this type of structure and makeup, and a market cap that’s seen exponential growth, any inkling of good news could cause the stock to rapidly move. Keep your eyes on ALCU as mounting signs point towards unprecedented copper demand which could provide a spark for continued vertical chart momentum.

Reason #2: An Economic Environment Tailor Made For Copper

(CSE: ALCU) (OTC: ALCUF)

The most recent consumer price index report revealed that inflation has reached a 40-year high. (Source 8)

Bond yields are also jumping, and as of Jan 19, 2022, the 10-year note spiked to nearly 2%, with the inflation-sensitive 2-year yield hitting 1%. This is a near 2-year high for both. (Source 9)

When markets sold off on Jan 18, 2022, UBS Global Wealth Management’s head of equities for the Americas, David Lefkowitz, said it was “all about interest rates” and that the 10-year’s surge “has big implications for the internals of the market.” (Source 9)

This reflects a Fed policy that has “overstayed its welcome” (Source 9) , contributing to the historical type of inflation we’re seeing.

Say hello to a potential copper bull market.

Traditionally, copper is seen as a strong hedge against inflation because its properties are essential for day-to-day life. It conducts heat and electricity and is malleable. It’s commonly used in electrical equipment such as wiring and motors. It is also valuable for construction (for example, roofing and plumbing) and industrial machinery (such as heat exchangers). (Source 10)

Computers and other electrical devices also use a great deal of copper, (Source 10) and copper wiring is likely powering wherever you are and behind your pipes and plumbing. (Source 11)

Yet outside of significantly outperforming the commodity it mines, Alpha Copper Corp. (CSE: ALCU) (OTC: ALCUF) may be an even better inflation hedge than the copper itself. An October 2020 Forbes article stated that “precious metals mining stocks probably provide a better inflation hedge than base metals and other commodities” and “rise with inflation but usually produce earnings even in non-inflationary times.” (Source 13)

Reason #3: An EV Boom, Greening Economy and Infrastructure Bill Dependent on Copper Explorer Like Alpha Copper Corp.

(CSE: ALCU) (OTC: ALCUF)

Reason #4: Alpha Copper Corp.’s Crucial Positioning In A Severe Supply-Demand Crunch

(CSE: ALCU) (OTC: ALCUF)

Top 4 Potential Catalysts for Alpha Copper Corp.

(CSE: ALCU) (OTC: ALCUF)

1. Bullish Indicators have Alpha Copper Corp. On Fire 🔥🔥🔥

2. Copper bull market due to unprecedented demand

3. Growing EV Boom, Greening Economy, and Infrastructure Bill are all dependent on Copper

4. Two Impressive Projects in a Mining-Friendly Region

Sources:

Source 1: https://alphacopper.com/wp-content/uploads/2022/01/PPT_AlphaCopper_V7.pdf

Source 2: https://www.barchart.com/stocks/quotes/ALCU.CN/interactive-chart

Source 3: https://schrts.co/FWHcMRvt

Source 4: https://schrts.co/ZaBTZven

Source 5: https://schrts.co/KaQNgWaI

Source 6: https://www.barchart.com/stocks/quotes/ALCU.CN/opinion

Source 7: https://finance.yahoo.com/quote/ALCU.CN/key-statistics?p=ALCU.CN

Source 8: https://www.wsj.com/articles/inflation-is-near-a-40-year-high-heres-what-it-looks-like-11639737004

Source 9: https://finance.yahoo.com/news/the-era-of-cheap-money-overstays-its-welcome-morning-brief-100752701.html?fr=yhssrp_catchall

Source 10: https://www.rsc.org/periodic-table/element/29/copper

Source 11: https://www.copper.org/education/c-facts/electronics/print-category.html

Source 12: https://www.copper.org/publications/pub_list/pdf/A6191-ElectricVehicles-Factsheet.pdf

Source 13: https://www.forbes.com/sites/billconerly/2020/10/17/its-time-for-inflation-hedges-consider-gold-mining-stocks-and-farmland/

Source 14: https://www.mining-journal.com/copper-news/news/1364930/%E2%80%9Ccopper-is-the-king-of-the-%E2%80%98green-metals%E2%80%99%E2%80%9D

Source 15: https://www.globalxetfs.com/whats-driving-coppers-rally/

Source 16: https://about.bnef.com/electric-vehicle-outlook/

Source 17: https://www.mining.com/ev-sales-expected-to-rise-by-2040-push-battery-metals-demand-report/

Source 18: https://www.mining.com/web/the-race-for-copper-the-metal-of-the-future/

Source 19: https://www.cnn.com/2021/07/28/politics/infrastructure-bill-explained/index.html

Source 20: https://www.mining-journal.com/copper-news/news/1342749/%E2%80%9Cprepare-for-decade-of-dr-copper-on-steroids%E2%80%9D

Article Last Update: June 1, 2022