Substantial Lithium Demand Has Unearthed a Major Opportunity for Ameriwest Lithium in North America’s Most Impressive Lithium Hotspots

News Update:

August 19, 2021 Ameriwest Lithium Announces Two Appointments Increasing Governance and Technical Expertise

August 10, 2021 Ameriwest, Brookfield, Converge at 52-Week Highs on News

August 9, 2021 Ameriwest Lithium Receives DTC Approval for U.S. Trading

August 9, 2021 Ellis Martin Report: Ameriwest Lithium (AWLI.CN) Advances Exploration in Clayton Valley, Nevada

August 4, 2021 AT Ameriwest, Doubleview, Docebo at 52-Week Highs on News

August 3, 2021 Ameriwest Lithium Advances Clayton Valley Exploration

July 15, 2021 Ameriwest Lithium Announces Appointment of Lithium Expert to Its Advisory Board

June 29, 2021 Ameriwest Lithium Announces Appointments of Chief Financial Officer and a Veteran Mining Engineer to the Company’s Strategic Advisory Board

June 2, 2021 Ameriwest Lithium Announces Closing of Over-Subscribed Private Placement

May 6, 2021 Ameriwest Lithium Announces Listing on the Frankfurt Stock Exchange

May 1, 2021 Ameriwest Lithium Announces Stock Option Grants

- By 2030, the world could see 125 million EVs on the road, only driving further demand for lithium supply.(1) In fact, according to Resource World, “It is anticipated demand for vehicle battery metal will increase sharply over the next several years as automakers abandon internal combustion engines for EVs.”(2)

- Unfortunately, there’s just not enough lithium supply available worldwife. Even the International Energy Agency just warned: “At least 30 times as much lithium, nickel, and other key minerals may be required by the electric car industry by 2040 to meet global climate targets.”(3)

- Today’s lithium market is roughly 350,000 tons and is forecast to grow to about one million tons in size by 2025. The capital to feed this growth in the supply chain needs to be raised and invested today — not in two or three years.(4)

- Ameriwest Lithium (CSE:AWLI) could play a vital role in lithium exploration. It currently has extensive operations in Nevada – arguably the hottest North American jurisdiction for lithium exploration.(5)

- The company’s Deer Musk East Lithium Project in Clayton Valley, Nevada, is five miles east of Albemarle’s Silver Peak Project. The other is the Railroad Valley Project, which the company believes could be the next Clayton Valley.(5) Unfortunately, there’s just not enough lithium supply available worldwide. Even the International Energy Agency just warned: “At least 30 times as much lithium, nickel, and other key minerals may be required by the electric car industry by 2040 to meet global climate targets.”(3)

The world is running into a problematic supply-demand situation with lithium.

All thanks to electric vehicle (EV) sales that are growing much faster than anyone expected.

By 2030, the world could see 125 million EVs on the road, only driving further demand for lithium supply.(1) In fact, according to Resource World, “It is anticipated demand for vehicle battery metal will increase sharply over the next several years as automakers abandon internal combustion engines for EVs.”(2)

Unfortunately, we simply do not have enough lithium supply at the moment for that to happen.

Even the International Energy Agency just warned:

The supply of critical minerals crucial for technologies such as wind turbines and electric vehicles will have to be ramped up over the next decades if the planet’s climate targets are to be met. At least 30 times as much lithium, nickel, and other key minerals may be required by the electric car industry by 2040 to meet global climate targets.(3)

In addition:(4)

- Today’s lithium market is roughly 350,000 tons and is forecast to grow to approximately one million tons in size by 2025. The capital to feed this growth in the supply chain needs to be raised and invested today — not in two or three years.

- Decarbonization has become the polarizing trend insuring 2021.

- The key to Energy Transition: security of supply of raw materials, in particular high-purity lithium.

- The market is scrambling to identify quality lithium resources as governments aim to develop homegrown lithium supply chains and develop subsidy programs.

That’s where a company like Ameriwest Lithium Canada CSE: (AWLI) could play a critical role. Especially when you consider its robust operations in Nevada- arguably the hottest North American jurisdiction for lithium exploration.(5)

Ameriwest boasts two strong properties. One is the Deer Musk East Lithium Project in Clayton Valley, Nevada, located five miles east of Albemarle’s Silver Peak Project. The other is the Railroad Valley Project, which the company believes could be the next Clayton Valley.(5)

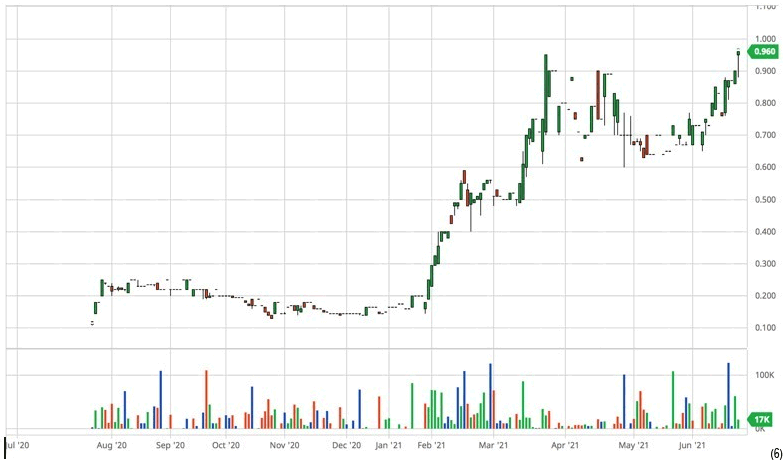

After breaking from consolidation at around 20 cents, the Ameriwest Lithium stock exploded to a peak of about 96 cents reached Jun 23, 2021. That was good for an explosive move of approximately 380%. If the stock can break above double top resistance at around 96 cents, it could potentially race to higher highs.

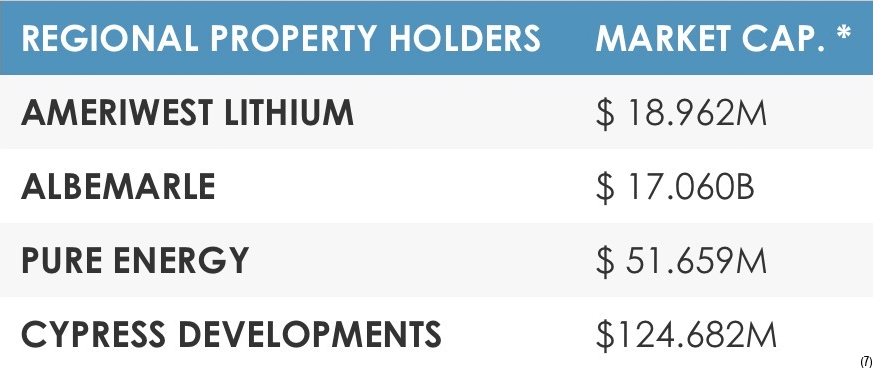

Given the considerable demand for lithium and its operations in the lithium-rich areas of Nevada, Ameriwest Lithium could be considerably more undervalued than its regional neighbors.

Ameriwest Lithium Canada CSE: (AWLI) focuses on unlocking value in a world shifting towards green energy solutions that run off lithium-based batteries. Its mission is to become a leader in exploring and developing world-class lithium and battery metal mining assets.

What really makes this company stand out is its operations in Nevada – arguably the hottest North American jurisdiction for lithium exploration.

Look at its Deer Musk East Lithium Project in Clayton Valley, Nevada, consisting of 283 claims spanning about 5,618 acres.(7)

Within that area:(7)

- Albemarle’s Silver Peak is functioning as North America’s only lithium-producing mine. Ameriwest’s property is located just 5 miles east of this property.

- Cypress Development Corp. recently completed a pre-feasibility study with a significant established resource estimate.

- Noram Ventures Inc. announced a resource of 300 million tons of >900 ppm Li. The current drilling program is on track to more than double that resource.

- Pure Energy minerals recently entered into an agreement for lithium brine production.

At the moment, Clayton Valley is host to the only commercially producing lithium project in North America, Albemarle’s Silver Peak brine evaporation project, as noted by Lithium X. Lithium X further stated that:(8)

“The Property is located in south-central Esmeralda County, Nevada, approximately 190 miles northwest of Las Vegas, Nevada and the same distance southeast of Reno, Nevada. Clayton Valley is an anomaly in several ways. It is in the center of lithium-enriched rocks and waters related to rhyolitic volcanism and associated hot springs that occur over hundreds of square miles. It has been an intact basin receiving fluids for millions of years, and those fluids are still at shallow depths because the valley is a stable knot in the dynamic Walker Lane and Basin and Range tectonic terrain. There are geologic arguments that lithium in this basin can be delivered via different processes to various reservoir rocks.”(8)

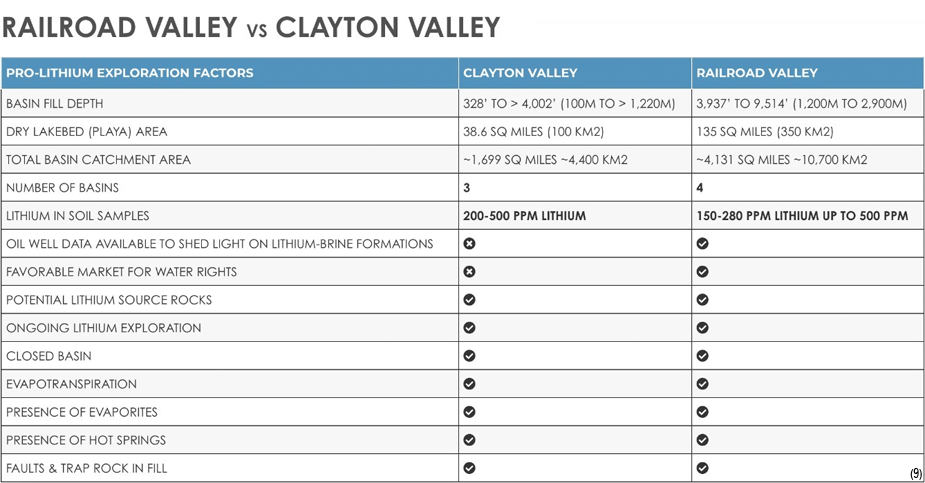

Ameriwest Lithium believes that its Railroad Valley Project may be the next Clayton Valley. For one, Ameriwest’s Railroad project encompasses 6,240 acres for a total of 312 placer claims. It is also located within the vicinity of Township 5 North, Range 55 East.(9)

There also could be a convergence of several factors favorable for lithium brine formation within the project area, including a deep hydrological reservoir covered by an evaporative playa. Railroad Valley also offers strong historical exploration data due to substantial efforts for oil and gas exploration.(9)

Most importantly, the Railroad Valley Basin is a Green-Fields Lithium Target Believed to be similar to Clayton Valley, just 200 KM to the West-Southwest.(9)

Although Railroad Valley is geologically similar to nearby Clayton Valley in many ways, there’s a huge difference. Railroad Valley represents a new and virtually unexplored target, with only a handful of companies present. In contrast, Clayton Valley’s leases are fragmented across multiple competing companies.(9)

When evaluating the potential for any lithium investment, it’s essential to examine the quality of the company’s management. Ameriwest Lithium certainly seems to be led by a powerhouse team.

David Watkinson – CEO

Mr. Watkinson brings over 30 years of professional engineering experience in underground and open-pit mining projects, including mine permitting, engineering, feasibility, construction, and operations for Emgold Mining Corporation. In addition to EMGold, Mr. Watkinson has extensive experience in project management, having taken projects from grassroots start-up levels to successful operating status. Mr. Watkinson has been responsible for managing large capital projects and operations in Canada, the United States, and the Philippines. He has held numerous senior positions, including but not limited to Placer Dome Inc., Kinross Gold Corporation, Thyssen Mining Construction, and Vulcan Materials Company. Mr. Watkinson holds a B.Sc. in Applied Science, Mining Engineering, from Queen’s University in Kingston, Ontario (1985) and is a Registered Professional Engineer in Ontario.

Glenn Collick — Director & COO

Mr. Collick is an entrepreneur who brings a wide range of experience and knowledge to the company. In 1983, Mr. Collick served as an Investment Advisor, which led him to extensive interest in the mining industry that has continued to the present. He has been involved in numerous mining ventures, including the Voisey’s Bay area discovery, by staking several hundred square kilometers for multiple public companies and instrumental in several mineral exploration projects in Argentina, Mexico, and Canada.

Mr. Collick has substantial experience in the renewable energy sector with Greenwind Power Corp. He was responsible for assessing them for their wind energy potential. Mr. Collick’s interest in renewable energy also extends to biofuels. He established a start-up company awarded a significant grant from the Province of Alberta to design and build a biofuel reactor using canola as feedstock.

For four years, Mr. Collick served as the Chief Relationships Officer of Atrum Coal NL on the Australian Stock Exchange responsible for the Groundhog Coal Discovery in Northern British Columbia. His responsibilities included consulting with the government, the First Nations, and other direct and indirect stakeholders in the project. They were specifically responsible for developing a positive working relationship between Atrum and the First Nations stakeholders.

Sam Eskandari — Director & Interim CFO

Mr. Eskandari has extensive experience in marketing and operational management for public companies, including budgeting, raising capital, and developing and executing successful growth strategies. His professional experience spans various industries, including pharmaceuticals, retail, mining, and technology.

Before his career in marketing and management, Mr. Eskandari was the General Manager of one of the flagship stores of Future Shop/Best Buy in Western Canada. He implemented a successful marketing and sales program resulting in the highest sales growth in a vital period within all stores in Western Canada. Mr. Eskandari is a graduate of Simon Fraser University (SFU) with a degree in Molecular Biology and Biochemistry. Mr. Eskandari has also been on the board of various public companies in the mining sector. As a serial entrepreneur, he has been a founder and/or co-founder of multiple companies over the past ten years. He is currently a Director and Interim CFO of Oakley Ventures Inc.

James Gheyle – Director

Mr. Gheyle began his career in the mineral exploration industry over 25 years ago. He has held many positions with various exploration-stage companies. He possesses extensive experience in the sector, having worked on multiple projects, including base metals, gold, and diamond exploration companies like BHP and De Beers.

In the early 2000s, Mr. Gheyle gained extensive experience in the oil and gas industry in Fort McMurray. He was employed by Red River Energy Consultants and was contracted out to several major oil companies. Over his tenure in the oil and gas industry, Mr. Gheyle held numerous positions, including drilling consultant and project manager. These all came while he served as part of the management team that supervised large drilling programs in the Fort McMurray area. In 2019, he began consulting for junior mineral exploration companies. Mr. Gheyle holds a diploma in Applied Science -Geology from BCIT (British Columbia (1997).

- By 2030, the world could see 125 million EVs on the road, only driving further demand for lithium supply.(1) In fact, according to Resource World, “It is anticipated demand for vehicle battery metal will increase sharply over the next several years as automakers abandon internal combustion engines for EVs.”(2)

- Unfortunately, there’s just not enough lithium supply. Even the International Energy Agency just warned: “At least 30 times as much lithium, nickel, and other key minerals may be required by the electric car industry by 2040 to meet global climate targets.”(3)

- Today’s lithium market is roughly 350,000 tons and is forecast to grow to about one million tons in size by 2025. The capital to feed this growth in the supply chain needs to be raised and invested today — not in two or three years.(4)

- Ameriwest Lithium (CSE:AWLI) could play a vital role in lithium exploration. It currently has extensive operations in Nevada – arguably the hottest North American jurisdiction for lithium exploration.(5)

- The company’s Deer Musk East Lithium Project in Clayton Valley, Nevada, is five miles east of Albemarle’s Silver Peak Project. The other is the Railroad Valley Project, which the company believes could be the next Clayton Valley.(5) Unfortunately, there’s just not enough lithium supply. Even the International Energy Agency just warned: “At least 30 times as much lithium, nickel, and other key minerals may be required by the electric car industry by 2040 to meet global climate targets.”(3)

Source 1: https://www.marketwatch.com/press-release/electric-vehicle-demand-already-creating-substantial-lithium-supply-issue-2021-06-02-91972749

Source 2: https://www.marketwatch.com/press-release/ev-automakers-will-have-to-brace-for-higher-battery-material-costs-2021-04-06-91973030?siteid=bigcharts&dist=bigcharts&tesla=y

Source 3: https://www.carbonbrief.org/iea-mineral-supplies-for-electric-cars-must-increase-30-fold-to-meet-climate-goals

Source 4: https://ameriwestlithium.com/investors/

Source 5: https://ameriwestlithium.com/about/

Source 6: https://www.barchart.com/stocks/quotes/AWLI.CN/overview

Source 7: https://ameriwestlithium.com/projects/clayton-valley/

Source 8: https://lithium-x.com/clayton_valley/

Source 9: https://ameriwestlithium.com/projects/railroad-valley/