Leocor Gold Inc is engaged in the acquisition and exploration of precious metal projects. The company holds interests in Dorset Gold Project located in the Province of Newfoundland, Canada, south of the Pine Cove Gold Mine and Shotgun Project located in the north-west of the town of Pemberton, British Columbia.

News Update:

July 14, 2021 Leocor Gold Raises $11 Million in Private Placement Offering

June 17, 2021 Leocor Gold Increases Private Placement Offering

June 2, 2021 Leocor Gold Commences District-Scale Exploration in Newfoundland

Find Out Why Leading Analysts Think You Can Make a Fortune Owning LECRF Today! Click here to read the report!

I’ve been warning friends and family for months now about the horrendous inflation that’s coming. For a time, I was called a crazy conspiracy theorist that belonged in a desert bunker. But now that the signs are here and looking uglier by the day, I’m not looking so crazy anymore.

It is so much worse, though, than anyone realizes, and it will get worse.

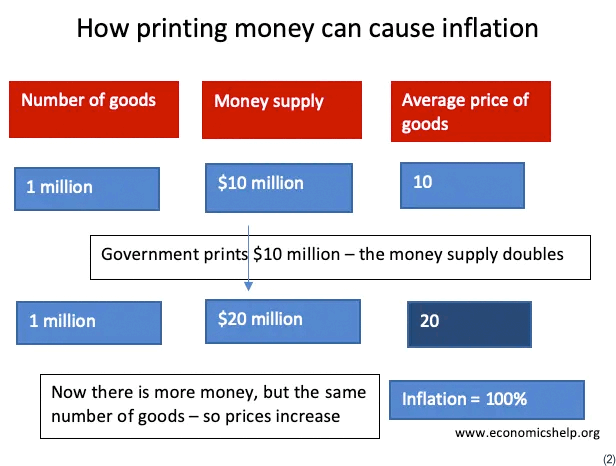

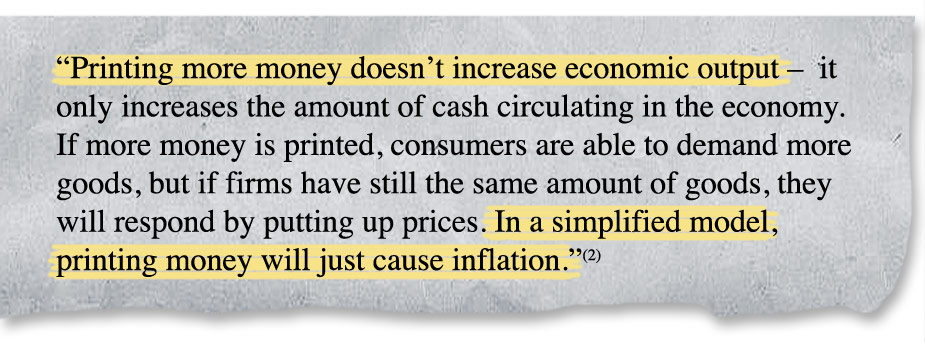

Keeping politics out of it, let’s have a little Economics 101 lesson. What in the heck do you think happens when money keeps printing as the GDP uncontrollably heats up? What happens when the Fed shows zero interest in tapering their bond-buying program or hiking interest rates? Meanwhile, the government just wants to spend more money.

Is this what utopia is supposed to look like?

This is basic economics, folks. Recklessly printing money does not work, and we have spending packages, after spending packages, after spending packages being proposed. The world isn’t shut down anymore, and economic activity is rebounding. What in the world do you think will happen?

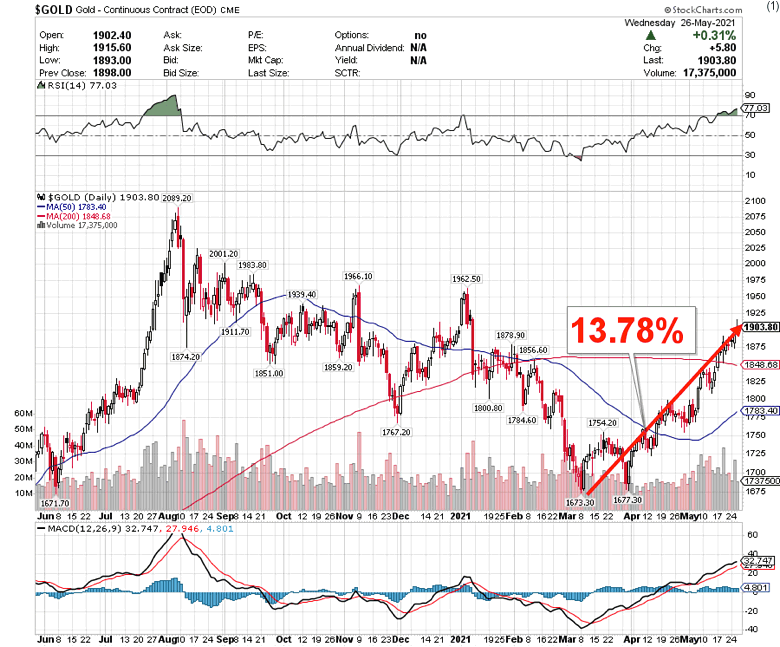

I have also been telling friends and family to potentially add gold exposure as a hedge for months and months. Many thought I was crazy when gold bottomed in March, and it reached its lowest point in almost a year at about $1673/oz.

But now that everyone sees the inflation crisis we have brewing and is leaving the supermarket, pharmacy, and gas station, cursing the world, things have changed. Since that March low, the price of gold has advanced 13.78% to a 4-month high of approximately $1903.80.

I have also been telling friends and family to potentially add gold exposure as a hedge for months and months. Many thought I was crazy when gold bottomed in March, and it reached its lowest point in almost a year at about $1673/oz.

But now that everyone sees the inflation crisis we have brewing and is leaving the supermarket, pharmacy, and gas station, cursing the world, things have changed. Since that March low, the price of gold has advanced 13.78% to a 4-month high of approximately $1903.80.

But the best part? We’re just about $185 away from the record high we saw last August. Judging by the climate we’re in, we could easily touch this again.

Let’s break down why.

The last time we saw an inflation scare like this, it was about 40 years ago when “The Great Inflation” occurred. But do you know what caused this? Reckless post-WWII Federal Reserve policies that permitted excessive growth in the money supply.(3)

Sound familiar? According to the New York Times, the latest $6 trillion budget proposal is the highest potential federal spending we’ve seen since after WWII.(13) Don’t ever let anyone tell you history doesn’t repeat itself.

During “The Great Inflation” between 1965–1982, we saw:(3)

- Four economic recessions.

- Two severe energy shortages.

- Unprecedented peacetime implementation of wage and price controls.

- Interest rates as high as 20%.

No wonder economist and Wharton professor Jeremy Siegel called this “the greatest failure of American macroeconomic policy in the postwar period.”(3)

During the peak of the Great Inflation, do you know what also happened? We saw the price of gold nearly triple in just one day in 1971 from $42 to $120 an ounce.(4)

But while gold for years has traditionally been a safe asset and inflation hedge, according to Forbes, mining stocks, such as Leocor Gold Canada CSE: (LECR) United States OTC: (LECRF), could be an even better inflation hedge than the mineral itself. Why? Because companies like this traditionally “rise with inflation but usually produce earnings even in non-inflationary times.”(5) Furthermore, “Precious metals mining stocks probably provide a better inflation hedge than base metals and other commodities.”(5)

With history repeating itself, we are in an environment showing eerie similarities to “The Great Inflation.” While the upside potential is at a once-in-a-generation type of apex for junior miners, not all of them are created equally. Some have more exciting upside than others for a variety of reasons.

With operations in an unexploited mineral-rich region and an all-star team including an award-winning gold prospector, Leocor Gold Canada CSE: (LECR) United States OTC: (LECRF) may have a gold mine of blue-skies ahead that only come around once in an era.

- The last time we saw an inflation crisis this bad was “The Great Inflation” between 1967-1982. During its height in 1971, the price of gold nearly tripled in one day from $42 to $120 an ounce.(4)

- “The Great Inflation” was caused by reckless post-WWII monetary spending policies that eerily compare to today’s.

- With inflation worsening, gold is now at about a 4-month high. After gold reached its lowest level in almost a year in March at about $1673/oz, it advanced roughly 13.78% to a 4-month high of approximately $1903.80.(1)

- We are now only about $185 away from gold’s record high we saw last August.(1)

- Back in October, Forbes stated that “Precious metals mining stocks probably provide a better inflation hedge than base metals and other commodities.”(5)

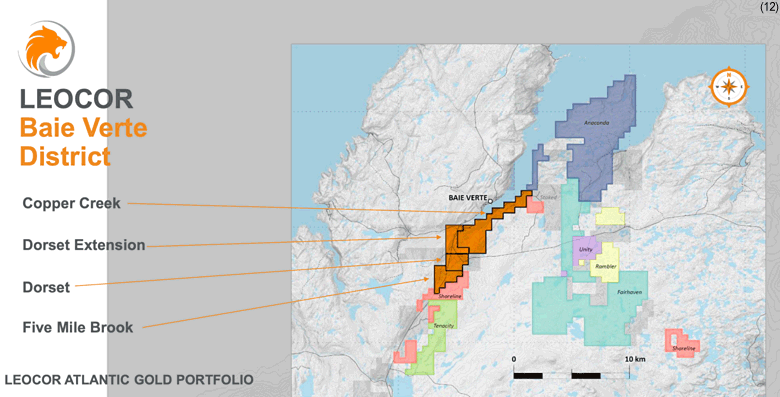

- With three major gold districts in overlooked, undervalued, and unexplored Newfoundland, Leocor Gold Inc has positioned itself as a rapidly growing resource exploration and development company.

- Newfoundland has one of the most extensive mining histories in Canada. Small-scale mining dates back to the 1770s, with mining becoming a lucrative industry by the 1860s. Today, it represents an emerging, underexplored gold district, where focused exploration for precious metals was essentially non-existent before the early 1980s.(12)

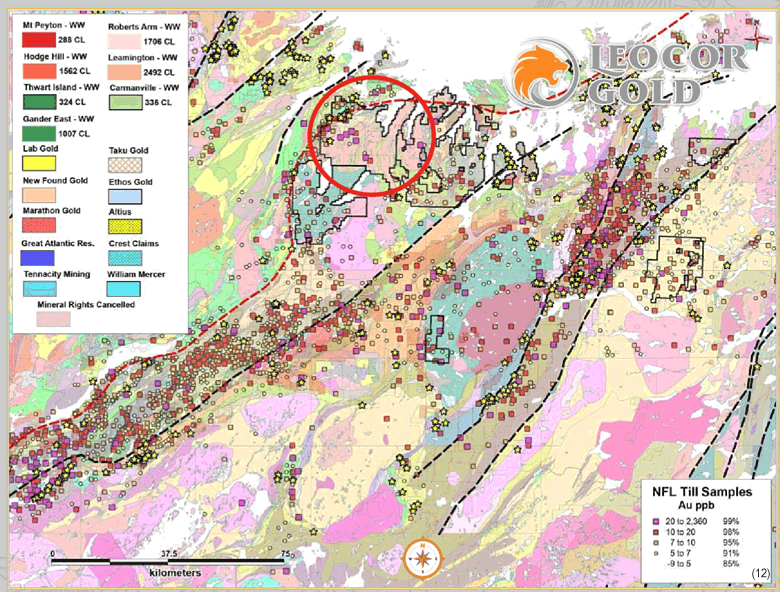

- Leocor’s Atlantic Gold Portfolio encompasses a total of 152,822 hectares (377,631-acres) across three separate mining districts: The Western Exploit District, Baie Verte District, and the Gander District across north-central Newfoundland’s Dunnage Zone.(12)

- The company’s Western Exploit District is about 144,000-ha and 100% owned, with 5,760 mineral claims, the Baie Verte District is 100% owned, with a 1,975-ha advanced gold exploration project, and the Gander District is a 70% owned, 6,847-ha gold exploration project.(12)

- Leocor has many bullish technical indicators, and its stock price has reflected gold’s rally. Ever since the stock bottomed on April 7, 2021, it rallied a potential 111.43% to its current price of roughly $0.74 CAD.(6)

- The company has several strong fundamental indicators such as its Altman Z-Score of potentially 45.6(9) and current ratio and quick ratio of roughly 36.9x(10) and 36.4x,(11) respectively.

- Leocor is run by talented executives with decades of successful experience in mining and business ventures as a whole. The recent addition of award-winning gold prospector Shawn Ryan could be a game-changer.

The company is currently approaching the 52-week high it reached in August 2020 when gold’s price peaked. Ever since the stock bottomed on April 7, 2021, coupled with gold hovering around 4-month highs, the potential 111.43% rally to its current price of roughly $0.74 CAD has been explosive.(6) After all, that would make sense due to gold’s enormous potential catalysts.

Many of the company’s technical indicators show bullish promise too, such as its 20 Day Moving Average, 20 – 50 Day MACD Oscillator, 20 – 200 Day MACD Oscillator, 50 Day Moving Average, 50 – 200 Day MACD Oscillator, 100 Day Moving Average, 150 Day Moving Average, 200 Day Moving Average, and 100 – 200 Day MACD Oscillator.(7)

Furthermore, when you consider that the stock’s float of about 28.46M is generally minimal,(8) this is a stock that has the potential to move and move fast. After all, a stock that advances over 111% in the matter of less than 2-months is one with explosive possibilities. On May 26, 2021, alone, for example, it moved about 12.12%.(6)

Fundamentally, the stock has a lot of things to cheer about too. Leocor’s Altman Z-Score of potentially 45.6(9) is over 15x more than the ideal score of 3, indicating robust financial health and low bankruptcy risk. Its current ratio and quick ratio of roughly 36.9x(10) and 36.4x,(11) respectively, also indicate that the company may have more than enough short-term assets to offset short-term debts and liabilities.

Leocor Gold Inc is a rapidly growing resource exploration and development company. It is principally focused on strategic growth leveraging overlooked, undervalued, or unexplored project potential in the province of Newfoundland, Canada. The region has become a hotspot for mineral exploration companies and investors looking for exposure to precious metals.

Newfoundland offers one of Canada’s most extensive mining histories, with small-scale mining dating back to the 1770s, which expanded into a major industry by the 1860s. As a result, the province offers world-class geology, significant infrastructure, and unparalleled access to a skilled workforce.

The Island of Newfoundland also represents an emerging, underexplored gold district, where focused exploration for precious metals was essentially non-existent before the early 1980s.

According to CEO Alex Klenman, “Newfoundland is getting ready to undergo one the most aggressive gold exploration phases since the 1988-89 rush where more than 80% of the known gold showings were discovered. With the compilation and interpretation of new data, Leocor is positioned for discovery on some of these key structures.”(12)

The company has assembled an experienced leadership and advisory team with decades of success in exploration and discovery, including award-winning and well-respected prospector Shawn Ryan.

Leocor’s district scale, Atlantic Gold Portfolio, encompasses 152,822 hectares (377,631-acres) across three separate mining districts: The Western Exploit District, Baie Verte District, and the Gander District across north-central Newfoundland’s Dunnage Zone.(12)

Its Western Exploit District is about 144,000-ha and 100% owned, with 5,760 mineral claims, the Baie Verte District is 100% owned, with a 1,975-ha advanced gold exploration project, and the Gander District is a 70% owned, 6,847-ha gold exploration project.(12)

The previous exploration has confirmed the presence of multiple zones of high-grade gold mineralization. According to Shawn Ryan’s data, the company’s most recent acquisition in its Western Exploit District may have new discovery potential at scale across previously unexplored lands.

Project 1: The Western Exploit District

The Baie Verte District is a 2,000-ha land package containing multiple gold occurrences and mineralized zones surrounded by active mine operations.

Located in North Central Newfoundland, Canada, this is a mining-friendly region initially opened up by Noranda Mines. The district consists of the Dorset, Dorset Extension, Five Mile Brook, and Copper Creek projects. It also extends on-trend across a highly structured and defined part of this mineral-rich region.

The Baie Verte District is also surrounded by mine operators, developers, and explorers such as Anaconda Mining, Rambler Metals & Mining, Maritime Resources, Tenacity Gold Mining Co., Fairhaven Resources, Unity Mining, Shoreline Aggregates, and others.

A) The Dorset Project

The Dorset Project is Leocor’s flagship exploration target in the Baie Verte District with abundant historical data and two significantly mineralized quartz veins with extensive surface showings. It is a 600-hectare project area containing multiple gold occurrences and mineralized zones, located just south of the Pine Cove Gold Mine in North Central Newfoundland on the Baie Verte Peninsula.

Leocor Gold optioned the property, wherein Leocor has the right to earn a 100% interest in the project by completing a series of cash payments totaling $1,250,000 over a four-year term. Additionally, Leocor will incur at least $1,500,000 of expenditures on the project over five years.

Leocor has also optioned an additional 325 hectares from Stanley H.B. Squires & Robert P. McGuire and consolidated the ground between and adjacent to the company’s central Dorset Gold Project and The Copper Creek project to form a contiguous land package.

Dorset gold mineralization is hosted by three subparallel, NE-trending quartz lode vein systems:(12)

The Main Zone includes three historical occurrences, with up to 409 grams per-ton (“g/t”) gold (“Au”) in grab samples, with channel sampling results of 177 g/t Au over 0.35m, 22 g/t Au over 1.5m, 17.2 g/t Au over 1.5m, and 14.7 g/t Au over 1.5m. Historic drilling includes 9.5 g/t Au over 1.3m.

A historic select sampling at the Braz Zone returned values of 314g/tAu,40g/tAu, 31.4 g/t Au, 21.2 g/t Au, 19.2 g/t Au, and 14.8 g/t Au. Historic channel sampling across the vein returned 9.5 g/t Au over 0.4m, 5.7 g/t Au over 0.5m, and 1.2 g/t Au over 0.65m. Weighted averages of historic rock sampling encompassing vein and mineralized wall rock returned values of 5.8 g/t Au over 1.9m, 3.1 g/t Au over 2.0m, and 2.5 g/t Au over 1.5m.

B) Copper Creek Project

Located in the north-central portion of the Baie Verte Peninsula, Copper Creek extends to within 1.6 km of the active Pine Cove gold mine.

The project’s southwestern section is host to numerous gold prospects and copper occurrences. These are associated with extensive alteration/shear zones developed within a thrust-faulted sequence of quartz-Fe-carbonate-fuchsite-altered gabbros, ultramafics, and mafic volcanics of the Advocate (ophiolite) Complex, and intermediate to silicic volcaniclastics & tuffs and micro gabbroic dykes/sills, of the Flatwater Pond (cover sequence) Group.

Previous assay results on the property include a channel sample of 3.9 g/t Au over 4m, and 16 g/t Au grab samples. Moreover, results showed roughly 7.33 g/t Au at the Biarritz North showing.

Historic sample assays at the Biarritz South prospect include 9.2 g/t Au & 4.05 g/t Au, in addition to sampling conducted by Anaconda (2004) and Chan (2013-2019) that collectively returned assays of 11.35 g/t, 3.08, g/t & 1.33 g/t Au.

The Tidewater and Powderhouse showings also produced grab samples of 8.23 g/t Au & 2.71 g/t Au respectively.

C) Five Mile Brook Project

The Five Mile Brook project consists of a single mineral license (25481M), comprised of 8 claims contiguous to the Dorset Gold Project.

Before the mid-1980s, the only recorded exploration work for the Five Mile Brook project consisted of reconnaissance work by Consolidated Rambler Mines Ltd, in 1976, along the western claim boundary area.

Three non-contiguous samples returned assays of: 1.63% Cu, 0.56 g/t Au, 226 g/t Ag & 0.28% Zn over 0.61 m; 0.32% Cu, 0.51 g/t Au & 3005 g/t Ag over 0.61 m; and 0.49% Cu, 0.62 g/t Au, 226 g/t Ag & 0.18 % Zn over 7.62 m.

Project 2: Baie Verte District

Introduced to Leocor by Shawn Ryan, The Western Exploit District now sits as Leocor’s most significant asset.

Three contiguous projects, Robert’s Arm, Leamington, and Hodge’s Hill, represent a 144,000-hectare (355,832-acre) land package in the heart of Newfoundland.

These projects cover numerous geologically favorable corridors conducive to gold mineralization across 5,760 mineral claims covered by 37 licenses.(12)

The claims are host to distinct magnetic high units (Gabbros) in settings indicative of known regional gold occurrences. Named after Gabbro, a hamlet near Rosignano Marittimo in Tuscany, these rocks are associated with continental volcanism, a region-specific gold target indicator.

A) Robert’s Arm Project

The Robert’s Arm Project is located in the northeast corner of the Western Exploit District at 42,650 hectares in size.

Location: The NW corner of the project is 2 km south of the community of Roberts Arm.

Claims: The claims cover 12 mineral licenses for 1,706 claims, or 42,650 hectares (426 square km).

Access: Highway 380 runs through the NW corner of the claim block, with Forestry roads running through 8 of the 12 licenses.

Highlight: The property straddles 38 km of the Red Indian Line suture zone. It also has approximately 200 km of magnetic high lineaments, which are untested gabbros.

Gold Targets:

The western and northern boundaries straddle 38km of the RedIndianLine(RIL) suture zone, the primary structural contact between the Laurentia and Ganderia Terrain boundaries. Some early gold exploration (1987 & 2004) and the RIL structure 50 km to the ENE uncovered over (30+) gold occurrences stretching along 22 km of the RIL – either on the RIL or within 6 km of the structure.

The minimal gold exploration in the NW corner of the project (late 1980s and early 1990s) discovered 4 gold occurrences associated with either the Red Indian Line structure or the Gummy Brook Gabbro.

The project has about 200km of distinct magnetic high units (Gabbros) outlining regional anticlines –synclines that have never been tested for gold. This is the same setting as one of the known gold occurrences (on a prospector claim in the SW corner of the project) and is the same geological setting as the Baie Verte (Pine Cove) deposit 50 km to the NNW.

The Newfoundland Government regional till survey post-1980s gold exploration, indicates anomalous gold and arsenic associated with the regional anticlines and gabbros. These till’s have never been investigated.

This is a unique opportunity as the majority of the claim block has never seen any gold exploration.

B) Leamington Project

The Leamington Project is the largest of the three Western Exploit District project areas at 62,300 hectares. It is located in the northwest corner of the District.

Location: A few smaller communities are situated on the project, such as Leading Tickles to the north, Point Bay to the west, and the largest, Point Leamington, located in the central area.

Claim: Covers 16 mineral licenses for a total of 2492 claims, or 62,300 hectares (632 square km).

Access: Highway 350 runs through the central part of the project, and highway 352 runs along the western side. There are many forestry roads in the area, providing easy access to 15 out of the 16 licenses.

Highlights: Targets close to 100 km (20km is on the Red Indian Line) of various regional structures. There is roughly 50-60 km of prospective gabbros with previously limited exploration, which offered grab samples of 2 to 5 g/t Au.

Gold Targets:

The northern boundary straddles 20 km of the Red Indian Line (RIL) suture zone. Thus, the primary deep-seated structural contract is also between the Laurentia and Ganderia Terrain boundaries.

The previous gold exploration (1987 & 2004) alongside the RIL structure 25km to the ENE uncovered over (30+) gold occurrences stretching along 22 km of the RIL; either on the RIL or within 6 km of the structure. The project is flanked to the east (30 km) by the Northern Arm Fault, which is the same fault system the Valentine’s Lake deposit (3.9 M/oz) straddles.

The project has seen minimal gold exploration. In 2004 a small exploration program (4-5 days) along the eastern area uncovered 2 new gold showings with grab samples running 2 to 5 g/t Au associated with the gabbros.

The project has about 50-60 km of Gabbros, with 90% never investigated. The same gabbro units 4-8 km to the east of the property have over 20 known gold occurrences.

The NFLD Government regional till survey indicates anomalous gold and arsenic samples which have seen minimal gold exploration. The area was historically explored for copper.

The project encompasses 3 major geological units;

To the West, mid to early Ordovician mafic marine volcanics of the Wild Bight group are composed of a mixture of wackes, basalts, and sandstone turbidites.

To the North to NNW, a 4 km wide trending zone composed of shales and mafic intrusives of gabbros, diorite, and tonalite.

On the Eastside, the project is mainly composed of turbidites, wackes, and conglomerates. Additionally, there are several prospective mafic gabbros, dikes, and sills throughout.

This is a unique opportunity as most of the claim block has never been explored for gold.

C) Hodge’s Hill Project

The project consists of 39,050 hectares located in the southwest corner of the Western Exploit District.

Location: Located 12 km north of the community of Badger along the Trans Canada Highway.

Claim: Covers 9 mineral licenses for a total of 1562 claims, or 39,050 hectares (390 square km).

Access: Forestry roads run through 8 of the 9 licenses.

Highlights: The project covers one of the most prospective rocks: a Pyroxene Gabbro. Gabrros have long been recognized in the past as being directly associated with gold mineralization in the Baie Verte area, such as Anaconda Mines Pine Cove deposit and, more recently, the discovery (2014) by Anaconda of the Stog’er Tight and Argyle showings.

Gold Targets:

Major Regional and NW Structure outlined by the regional NFLD airborne magnetics.

Anomalous NFLD Till sample in gold and arsenic sitting right on the regional structure.

Most of the project has never had a claim staked on it.

This is a unique opportunity to be the first company to evaluate the Hodges Hill gabbro.

The Geological Survey of Canada (OpenFile8658) specifically indicates how the brittle nature of the gabbro-tonalite-granodiorite body (Cripple-back intrusive suite) underlies the Wildling lake showing and Valentine lake discovery (3.9 M/oz). These make excellent prospective comparables.

Project 3: Gander District

The Gander District is Leocor Gold’s third significant gold-producing district. It is best known for the Startrek Property.

Startrek Property

The Startrek Property is a grassroots-stage mineral exploration property totaling 6,847 hectares, located 20 km east of the town of Gander in north-central Newfoundland.

The property is in the Gander Mining Zone, underlain by rocks of the Gander Group. They are divided into early to middle Ordovician Indian Bay Big Pond Formation, Cambrian and Early Ordovician Jonathan’s Pond Formation, and the Square Pond Gneiss.

Extensive surveys including a 402 line-km, fixed-wing, high-resolution aeromagnetic gradiometer, and digital VLF-EM Survey defined numerous bedrock conductors suggestive of semi-massive to massive sulfides. Together with historical data, this new information generated new targets for ground-truthing and follow-up exploration.

The Project contains three areas of interest, the Western, Central, and Eastern Zones. More than 50 gold occurrences have been discovered on the property through previous trenching and grab samples.

The Western Zone features gold mineralization outlined for 2km, with grab samples up to 3.5 grams-per-ton (“g/t”) gold (“Au”) in quartz stockwork. Veins also featured epithermal features, arsenopyrite, and trace amounts of stibnite.

The Eastern Zone has been traced for 2km and displays characteristics of hydrothermal alteration, with solidification, albite, and tourmaline. Assays range from 12 ppb to 3.5 ppb Au and average 130 ppb Au.

The Central Zone has seen trenching by Rubicon Minerals, which focused on gold showings in epithermal veining. It produced highly anomalous gold, arsenic, and antimony values. Sampling by White Metal also produced grab samples up to 40 g/t Au.

A company is only as strong as the people running it. Leocor is run by talented executives with decades of successful experience in mining and business ventures as a whole. However, the recent addition of Shawn Ryan as a Technical Advisor could genuinely position this company as a game-changer. After all, it’s not very often that an award-winning gold prospector falls into your lap.(12)

Alex Klenman | CEO and Director

Mr. Klenman brings over three decades of public and private sector business development, finance, marketing, branding, media, and corporate communications experience as CEO of Leocor Ventures. After a decade in private sector media-related positions, including notable board positions with CKVU Television and Canwest Pacific Television in Vancouver, he began his career in the public markets in the late 1990s serving in business development and communications roles for publicly listed Internet and tech companies.

Over the past decade, Mr. Klenman has held senior management, consulting roles, and board positions with multiple TSX Venture and CSE-listed companies. As a consultant, he worked closely with well-known TSX Venture listed resource companies such as Roxgold Inc. and Forum Uranium. He currently holds board and senior management positions with several publicly traded resource companies, including Nexus Gold Corp, Azincourt Energy, Arbor Metals Corp, Manning Ventures, Tisdale Resources, Cross River Ventures Corp, and more.

Zula Kropivnitski | CFO and Director

Ms. Kropivnitski has been the Chief Financial Officer and Secretary of the Company since October 11, 2012, and a director of the Company since October 21, 2015. Ms. Kropivnitski has served as the Chief Financial Officer and director for various public companies and has been instrumental in their growth. Her role as Chief Financial Officer includedLexagene Holdings Inc, Healthspace, Abraplata Resource, and Shelby Ventures Inc. Ms. Kropivnitski had also been a director at Rockshield Capital Corp from November 2016 to November 2017. In addition, Ms. Kropivnitski continues to serve as a Controller of Preakness Management Ltd., a private company.

Ms. Kropivnitski has over ten years of international experience in the resource sector. Ms. Kropivnitski served as the Controller to Sacre-Coeur Minerals and African Queen Mines Ltd. She served as Senior Accountant to Manex Resource Group and its group of mining exploration companies. During her tenure, she was responsible for all areas of financial reporting, corporate finance, and regulatory compliance. Ms. Kropivnitski received her Certified General Accountant professional accounting designation from the Certified General Accountants Association of British Columbia, Canada. She later obtained her ACCA designation from the Association of Chartered Certified Accountants. She also has a Master of Mathematics and a Master of Economics.

Shawn Ryan | Technical Advisor

Shawn Ryan began his career in exploration in the early ’80s working with the Kidd Creek Exploration geophysics team and various other local contracting firms. In 1996, while living in Dawson City, Yukon, he decided to try his luck as a prospector. He focused his prospecting in the Dawson District, looking for the sources of alluvial gold. His research led to perfecting a deeper soil sampling technique that became a Yukon industry standard.

Shawn received the Spud Huestis Award for excellence in prospecting and mineral exploration from AME BC in 2010 for the White Gold Discovery. In 2011, a New York Times profile went so far as to christen Ryan, ‘the king of a new Yukon Gold Rush.’ He was also honored that year with the Bill Dennis, Prospector of the Year Award by the PDAC for his prospecting success that led to the discovery of the White Gold Property and the Coffee Projects. These projects are now owned by Newmont.

Alexander “Sandy” Stares | Director

Mr. Stares has over 25 years of experience in mineral exploration, spanning a variety of Canadian geological terranes, from Newfoundland to the Yukon. He has also completed several tours prospecting in Indonesia and Mexico. Before forming his own Contracting Company, Stares Prospecting Ltd., Mr. Stares worked with IndoMetals, Rubicon Minerals Corporation, Freewest Resources of Canada, New Millenium, Lac Des Isle Mines, and Noranda. He was instrumental in the discovery of the H-Pond Gold Prospect and the Lost Pond Uranium Prospect. He also discovered numerous significant mineral occurrences in Canada and abroad, which have been the subject of extensive exploration programs.

Mr. Stares has served as President and CEO of Metals Creek Resources Corp. since December of 2007 and is also currently a director of White Metal Resources Corp., a director of the Qalipu Development Corporation, and an alternate Director of the Newfoundland and Labrador Prospectors Association. In February of 2013, Mr. Stares was awarded the Queen Elizabeth II, Diamond Jubilee Medal for his dedication to his Peers, Community, Canada, and the Prospecting Community. He was also one of the PDAC “Bill Dennis Prospector of the Year” Award recipients in March of 2007.

Newman Wayne Reid | Director

Mr. Reid has over 40 years of experience in exploration and mining geology, spanning various geological terrains, from Newfoundland to Northern B.C. and Alaska. He has held senior positions with various public companies and projects in mining and exploration, including Noranda Inc., Hemlo Gold Mines, Echo Bay Mines Ltd., and St. Andrew Goldfields Ltd. Mr. Reid was part of the team involved in the discovery of the Brewery Creek Gold Deposit in Yukon Territory and the Boundary Massive Sulphide Deposit/Duck Pond Mine in Central Newfoundland. His experience includes gold, base metal, and uranium/REE exploration in most geological environments in North America. He has over 20 years with the Noranda / Hemlo group in District and Regional manager capacity across Canada.

Mr. Reid holds a BSc. in Geology from Memorial University in Newfoundland. He has a Professional Geologist designation from Professional Engineers and Geoscientists – Newfoundland and Labrador. He has been a director and senior officer with several junior exploration companies. He is currently serving as a director of Manning Ventures Inc. and Metals Creek Resources Corp. and as Vice President of Exploration of Quadro Resources Ltd.

- The last time we saw an inflation crisis this bad was “The Great Inflation” between 1967-1982. During its height in 1971, the price of gold nearly tripled in one day from $42 to $120 an ounce.(4)

- “The Great Inflation” was caused by reckless post-WWII monetary spending policies that eerily compare to today’s.

- With inflation worsening, gold is now at about a 4-month high. After gold reached its lowest level in almost a year in March at about $1673/oz, it advanced roughly 13.78% to a 4-month high of approximately $1903.80.(1)

- We are now only about $185 away from gold’s record high we saw last August.(1)

- Back in October, Forbes stated that “Precious metals mining stocks probably provide a better inflation hedge than base metals and other commodities.”(5)

- With three major gold districts in overlooked, undervalued, and unexplored Newfoundland, Leocor Gold Inc has positioned itself as a rapidly growing resource exploration and development company.

- Newfoundland has one of the most extensive mining histories in Canada. Small-scale mining dates back to the 1770s, with mining becoming a lucrative industry by the 1860s. Today, it represents an emerging, underexplored gold district, where focused exploration for precious metals was essentially non-existent before the early 1980s.(12)

- Leocor’s Atlantic Gold Portfolio encompasses a total of 152,822 hectares (377,631-acres) across three separate mining districts: The Western Exploit District, Baie Verte District, and the Gander District across north-central Newfoundland’s Dunnage Zone.(12)

- The company’s Western Exploit District is about 144,000-ha and 100% owned, with 5,760 mineral claims, the Baie Verte District is 100% owned, with a 1,975-ha advanced gold exploration project, and the Gander District is a 70% owned, 6,847-ha gold exploration project.(12)

- Leocor has many bullish technical indicators, and its stock price has reflected gold’s rally. Ever since the stock bottomed on April 7, 2021, it rallied a potential 111.43% to its current price of roughly $0.74 CAD.(6)

- The company has several strong fundamental indicators such as its Altman Z-Score of potentially 45.6(9) and current ratio and quick ratio of roughly 36.9x(10) and 36.4x,(11) respectively.

- Leocor is run by talented executives with decades of successful experience in mining and business ventures as a whole. The recent addition of award-winning gold prospector Shawn Ryan could be a game-changer.

Source 1: https://stockcharts.com/h-sc/ui

Source 2: https://www.economicshelp.org/blog/634/economics/the-problem-with-printing-money/

Source 3: https://www.federalreservehistory.org/essays/great-inflation

Source 4: https://www.thebalance.com/gold-prices-and-the-u-s-economy-3305656

Source 5: https://www.forbes.com/sites/billconerly/2020/10/17/its-time-for-inflation-hedges-consider-gold-mining-stocks-and-farmland/

Source 6: https://yhoo.it/2RH2h8n

Source 7: https://www.barchart.com/stocks/quotes/LECR.CN/opinion

Source 8: https://finance.yahoo.com/quote/LECR.CN/key-statistics?p=LECR.CN

Source 9: https://finbox.com/OTCPK:LECR.F/explorer/altman_z_score

Source 10: https://finbox.com/OTCPK:LECR.F/explorer/current_ratio

Source 11: https://finbox.com/OTCPK:LECR.F/explorer/quick_ratio

Source 12: Leocor Gold Investor Deck- Client Provided Material

Source 13: https://www.nytimes.com/2021/05/27/business/economy/biden-plan.html